I just arrived at my office! Overslept today!

I hope all of you will have a wonderful long weekend! Good luck with your trades today.

Friday, May 25, 2007

No trading today!

Thursday, May 24, 2007

052407 - DIS - Daily

Filed Under ~ Long-Term Trades

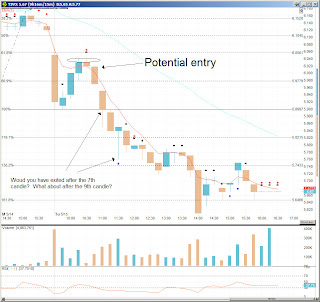

052407 - KOMG - 15mins - Loss*Paper

Symbol: KOMG

Type: Long

Entry: The beginning of the 15th bar

Exit: Stopped-out during the 21st bar

Result: Lost -1.27%

Wow! Was I able to catch this at the beginning of the 3rd candle, I would have made a killing... on Paper! I hope some of you were able to catch this! It was a very busy morning, from my day-job, and I hardly have time to pay attention to any set-ups. I noticed that (KOMG) has been falling and falling, and I was hoping to catch the bottom and ride a small reversal move.

The 14th bar painted a Hammer, and I took a chance and entered at the beginning of the 15th bar. But the prices couldn't even get to the next Fib. level (from Day-high to Day-low.) My Protection Stop was set to the bottom of the 14th, and it was reached at the 21st bar.

I didn't manage a win, but at least I managed an experiment!

Filed Under ~ Losses*Paper, Paper Trading

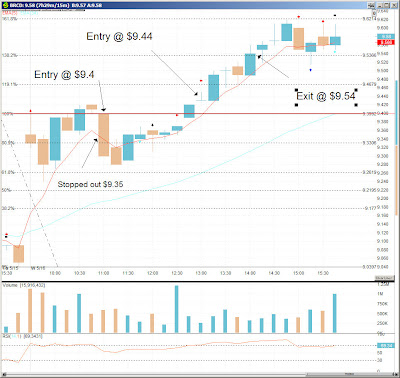

052407 - DLB - 15mins - Loss*Paper

Symbol: DLB

Type: Short

Entry: During the 8th bar

Exit: Final bar of the day

Result: Lost -0.34%

When the 8th bar painted a weak bearish signal, covering both the 6th and the 7th bar, I really thought I could NOT go wrong with this trade. The Bearish Engulfing happened again on the 13th bar, but still, it didn't happen. Looking back at the chart now, I noticed that there were hardly any volume! (Something that I didn't pay attention to when I was executing my Paper Trade.) Anyway, my Protective Cover was set at the top of the 8th. It never got there, but it also never hit my target. I covered my short prior to the market closes.

Filed Under ~ Losses*Paper, Paper Trading

Estocastica - http://estocastica.blogspot.com

Today I came across this post from Estocastica... saying that he will pull the plug on his Blog at midnight tonight.

Personally, I have learned a lot from Esto, and I really hope that he will continue with his post, even on a once-a-week basis. However, I did notice that the Post Date of "All Good thinks must come to an end" is dated December 24, 2007. I wonder if Esto was preparing his post now, for later this year, but accidentally pressed 'publish' without even noticing it. If so, the good news is... I still get to learn from Esto for a few more months. The bad news is... if he is already planning for December, when it is only May, when the time comes, I'm sure there will be no turning back.

Esto, if you are reading this, maybe you can do what Kevin did at Kevin's Market Blog. He announced that he's ending his site here, and later decided to continue his blog with less frequent postings.

Regardless, I'm sure both Esto and Kevin have their reasons for whatever decision that they make. I fully respect that! Let me take this opportunity to thank them both (and 00NR7 of course) for their contributions to my daytrading education. Thanks!

Update #1: I checked Esto's blog just now (5/25 1312hrs), and it is still 'live' but without new postin.

Filed Under ~ Misc.

Wednesday, May 23, 2007

Tuesday, May 22, 2007

052207 - AEO - 15mins - Loss*Paper

Type: Long

Entry: The 10th Bar

Exit: Stopped out on the 15th Bar

Result: Lost -0.39%

Another perfect example of forcing a trade. I was looking for a quick reversal trade from (AEO) by picking out the strong closing 8th and 9th bar. The 10th bar was an upside-down hammer that closed above the 5eMA. I thought it would mark an end to the downward movement, and hoping that the prices will begin to rise. Although it managed to stay above the 5eMA, the prices never went far up, and eventually dropped the 5eMA hitting my Protective Stop of $28.25 during the 15th bar.

Filed Under ~ Losses*Paper, Paper Trading

052207 - SPSN - 15mins - Loss*Paper

Symbol: SPSN

Type: Long

Entry: The 10th Bar

Exit: Stopped-out on the 10th Bar as well

Result: Lost -1.59%

I forced this trade in because I'm itching to make some money! But I always forget that this type of setup is never really my strength. When the 9th bar painted a hammer, I thought the prices are going to reverse, and then rise. I entered almost at the high of the 10th bar, and the prices fell minutes later. My Protective Stop was hit in the same bar. This is pathetic!

Filed Under ~ Losses*Paper, Paper Trading

My 100th - Watchlist for May 22

Wow, I just noticed that this is my 100th posts!

I didn't trade yesterday as I had to take my wife to the Doctor. (Sorry for not informing.)

I am looking at the following symbols:

KONG, SPLS, WYNN, MGM, LVS, NFI, CELG, TNE, BYD, SPSN, ENER, & AEO.

This list is way too 'Gaming-Industry-Heavy.' So far, I have yet to see any set-up that is worth even a closer look. I doubt that I will be executing trades today.

Feel free to share your watchlist!

Happy 100th to me! :-)

Sunday, May 20, 2007

200704 - Month-end Review (Paper)

Since I switched back to Paper Trading, the results are somewhat promising in my opinion.

Total Trades: 21

Winning Trades: 13 (~62%)

Losing Trades: 8 (~38%)

Profit/Loss: $221.27

Commissions: ($419.58)

Total Profit/Loss: ($198.31)

% Profit/Loss: -0.50%

One thing that I want to note is that all individual trades are based on a $5000.00 purchase, regardless of the price of the stock. My primary objective for April, is to monitor the accuracy of my observation on Entry and Exit points. That's why I kept the separate entry to track the commissions, which I believe it can help me to gauge the effect if I want to evaluate other online brokers' commission structure.

What I want to focus on, is the number of Winning Trades vs Losing Trades. In this case, a 62% win is encouraging to me.

Filed Under ~ Month-end, Paper Trading

200704 - Month-end Review

April concluded with a major change... back to Paper Trades!

I decided to switched back to Paper Trades because I felt that I was 'short cutting the learning curve.' Below is a summary of my real money trades from April 2-April 19...

Total Trades: 7

Winning Trades: 3

Losing Trades: 4

Profit/Loss: ($223.28)

Commissions: ($139.86)

Total Profit/Loss: ($363.14)

% Profit/Loss: -0.91%

Which brings my Total Profit/Loss of my first 2 months of trading to: ($816.58)

This is/was the reason why I decided to go back to Paper Trading.

Filed Under ~ Month-end, Paper Trading

Friday, May 18, 2007

051807 - SEPR - 15mins - Gain*Paper

Symbol: SEPR

Type: Short

Entry: Mid-way through the 5th bar

Exit #1: The 7th bar @ 138% Fib.

Exit #2: The 9th bar @ 161% Fib.

Result: Gained +4.14%

I just stumbled upon this setup as I was going through my Watchlist. By the time I made an entry, the prices were already at $47.21. Ideally, had I caught this setup sooner, my entry would have been right underneath the 4th bar low. The Target was at the 138% Fib, and my Protection Cover is at the Opening Low.

I didn't have to wait long after I entered the trade to see the price to keep on falling. I hit my Target 2 bars later, and I decided to Cover half of my position. I Covered the remaining half of my position when the prices hit the 161% Fib level. A very nice profit!

When the 10th bar completed, I thought about going Long. But the prices were so erratic, by looking at the Sales Ticker, I just don't feel comfortable making further moves, even though it is only Paper Trading.

Looking back now, I also see a potential entry for Long at around 1330hrs. But this is all aftermath.

So with this trade, I conclude the week with 5 trades. 3 wins and 2 losses.

Although they are all paper trades, I'm very satisfied with my results.

I hope my readers also had a successful trading week. Please feel free to share your stories!

Filed Under ~ Gains*Paper, Paper Trading

Watchlist for May 18

Good Morning!

These are the stocks that I'm watching right now...

DRYS, SEPR, INTC, MT, INTU, AKAM, OMX, and VCLK

Thursday, May 17, 2007

No Trading Today

Got a day-long off-site training today. No, it's has nothing to do with the Wall Street!

051607 - BRCD - 15mins - Gain*Paper

Symbol: BRCD

Type: Long

Entry #1: The beginning of the 7th bar

Exit #1: Mid-way through the 7th bar

Entry #2: The beginning of the 15th bar

Exit #2: The 19th bar

Result #1: Lost -0.53%

Result #2: Gained +1.06%

I took a (somewhat) low risk entry at the beginning of the 7th bar when I noticed that the 6th bar closed above the Opening Range High. The lower shadow of the 6th bar also led me to believe that Support has been established at Opening High. Unfortunately, my analysis was wrong. I was stopped out within the same bar.

I took another entry at the beginning of the 15th bar. This time, I noticed that the 14th bar closed strong, and the 13th bar had an unusually high volume. That's when I though the momentum was picking up. Although, it casted some doubts over me when the 15th bar is completed. I reached my target of 138% Fib., four bars later.

Filed Under ~ Gains*Paper, Paper Trading

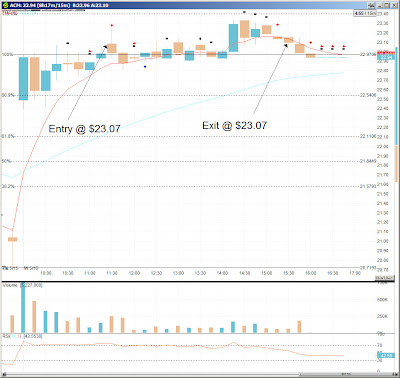

051607 - ACM - 15mins - Loss*Paper

Symbol: ACM

Type: Long

Entry: The 9th bar

Exit: The 25th bar

Result: Lost -0.04%

My strategy for this trade is to go Long when the prices closed above the upper shadows of the 4th and 8th bar. The 9th bar accomplished that, but it failed to hit my target of 119% Fib. It came close at around 2pm, but the prices retraced back the 5eMA. I exited at almost the same as the entry price for a small loss.

Filed Under ~ Losses*Paper, Paper Trading

Wednesday, May 16, 2007

Watchlist for May 16

AMAT, JBX PAYX KLAC, NX, EYE, ASML, ACM, LRCX, CVLT, BRCD, NVLS.

I did 2 trades so far on BRCD and ACM, and both got stopped out. (Charts to follow later today.)

I re-entered BRCD @ the 15th bar. We shall see how it turns out.

Please feel free to drop me a note to tell me what's in your watchlist!

Good Trading!

Tuesday, May 15, 2007

051507 - TIVO - 15mins - Observation

My initial target was at the Opening Low of the day. I don't know if I would be bothered by the long lower shadow of the 7th bar. Chances are... I might.

Then again, the ultra long lower shadow of the 9th bar, would have, once again, prompted me to take profit.

Although this is a potential winning trade, I would still like to learn how to interpret the 7th and the 9th bar. Your observation is fully appreciated!

Filed Under ~ Observation, Paper Trading

051507 - STEC - 15mins - Gain*Paper

Symbol: STEC

Type: Short

Entry: The 10th bar, when the prices broke the 9th bar low

Exit: The 15th bar at the 119% Fib. Ext.

Result: Gained +1.93%

(STEC) gapped on opening, followed by a hammer-type 2nd candle with a long lower shadow. Based on the 2nd candle, I almost took this stock out of my watchlist, because I know I would not feel comfortable entering Short, when prices are still 'within the shadow.' But since my watchlist wasn't that long today, I left (STEC) there. The 5th bar broke away from the Opening Low, but closed with a small lower shadow. The 7th bar continued to produce a lower shadow, but it confirms the support when I drew a line across (see yellow line.)

This is when I set my entry to slightly below the yellow line, since I noticed that a sizable gain can still be achieved if prices only reached the 119% Fibonacci Extension.

The entry took place rather soon during the 10th bar, and my exit point was reached during the 15th bar. Everything just worked out as planned.

Filed Under ~ Gains*Paper, Paper Trading

Watchlist for May 15

I have yet to come across anything that is worthy of 'close monitoring.'

Right now, I'm overlooking the following:

STEC, TIVO, TJX, GMR, and PCS

Earlier this morning, I also had the following on my list but I disqualified them for one reason or another...

BSTE, TRA, HTLD, IGLD, AMGN, TW, and MR

If you see anything that is worthy for paying closer attention, please drop a note. Thanks for the heads-up!

Monday, May 14, 2007

Watchlist for May 14

I'm back!

I'm monitoring the following stocks this morning...

RDY, IRF, NOK, RFMD, GERN, GM, F, & SCRX

Thursday, May 10, 2007

Wednesday, May 2, 2007

No trading until Week of 5/21

I'm pretty much jam-packed with meetings for the next 10 days.

I am still trying to work on my month-end result for April. I will post it as soon as it becomes available.

Good luck to you all!

Tuesday, May 1, 2007

No trading today!

There will be no trading today! Thank you to those who voted in my first ever 'Predict the move' post.

Good luck to your trading today.