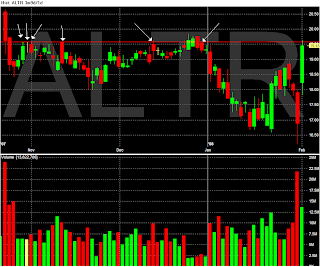

Well, new to me. I am not sure how long have they been blogging, but I have just discovered them in the past few days.

By the way, PRD stands for Positive Range Divergence. Just in case you don't know.

(What do you think? Of course I didn't know either!! PRD Trader told me!)

Good Trading!