- I shorted UMPQ on Tuesday during the opening hour

- My Stop was conservatively set to the High of Friday

- My Target of $11.00 (round dollar) was reach today, and I exited my entire position

Thursday, February 24, 2011

UMPQ – Short – Swing

Filed Under ~ Gains, Swing Trades, Wall St. Warrior

Wednesday, February 23, 2011

MDY – Stopped Out

- I entered Long on MDY back in early February

- I set out not to turn this winning trade into a losing trade

- However, I was just too greedy

- The Hammer Bearish Reversal on Friday should have set off a sell signal

- Looking back now, I should have set my Stop more aggressively at high $175.xx

- But hindsight is always perfect, isn’t it?

Filed Under ~ ETFs, Gains, Swing Trades

Thursday, April 19, 2007

20070419 - GOOG - Daily - Gain

After reading Kevin's post on (GOOG) yesterday, I have decided to exit my holdings on GOOG before the market close today.

I earned a 'whopping' 65 cents per share! Hardly enough to cover my transaction fees!

Although Google released some very impressive numbers on their earnings, just like what Kevin mentioned, 'trading the Earning Release' is very risky. If you think about it, those CEOs or CFOs are basically going to come out and say... Earnings are:

1) Above Expectations

2) Meet Expectations

3) Below Expectations

Under normal circumstances, only 'Above Expectations' would bring you 'winnings', assuming that you are 'Long' on the Stocks. The other 2 results will likely to bring the share price down! Therefore, you are betting against the odds of 1 out of 3 that the price will go up.

Of course, you can argue that if you go 'Short' before the Release to get the odds in your favor! But are you really going to bet against companies like Google?

Anyway, I might not be making any sense at all on this topic. But at least this is how I see it when it comes to playing the Earnings game.

Let me know what you think!

Filed Under ~ Gains

Monday, April 9, 2007

20070409 - TRN - 15mins - Gain

Type: Long

Entry: The beginning of the 6th bar (The arrow was at the wrong candle. It's the one after the hammer)

Exit: The 10th bar when it crossed the 138% Fib. Extension

Result: Gained +1.44%

A strong 4th bar followed by a Hammer-like candle on the 5th bar with a rising 5eMA led to go Long on this setup. Looking back now, I don't know if I have made the correct decision because the entry price was already closing in on the 119% Fib. Extension. Had the price not move beyond the 119 level, I don't know if the profit/loss ratio is that attractive at all.

But as soon as I entered the trade, the price just went loose and continued to rise. I monitored my stop closely and made adjustments. As soon as my 'entry-bar' had completed, I knew that I need to adjust my target to the 138% level. Unfortunately, it was reach 4 bars later and I exited. I'm happy!

Filed Under ~ Gains

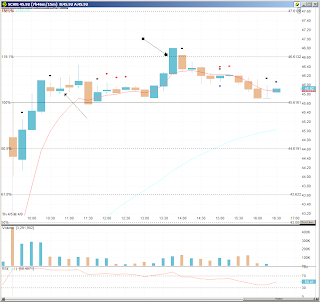

20070409 - SCHN - 15mins - Gain

Type: Long

Entry: The beginning of the 6th bar

Exit: The 18th bar at Fibonacci Extension

Result: Gained +1.44%

SCHN gapped up with a weak Opening Bar. It then followed by 3 strong bars leading beyond the Opening High. The 5th bar is a weak Doji-like candle that closed above the Opening High. With the rising 5eMA, I took a low-risk entry at the beginning of the 6th bar. My target was 119% Fib. Extension. I was cautioned during the weak 9th bar, followed by a series of Narrow-range bars. Thankfully, it took off during the 16th bar, and hit my target 2 bars later.

Filed Under ~ Gains

Saturday, March 31, 2007

20070330 - PMCS - 15mins - Gain

Symbol: PMCS

Symbol: PMCS

Type: Long

Entry: The beginning of the 7th bar

Exit: The beginning of the 13th bar

Result: Gained +1.86%

With my recent losses, I have decided to be more patience with my entry, and learn to take less risky move. The 5th bar was started from the Opening High. But without knowing where the bar would ended, I decided to wait till the 5th bar is over to look for further signs. It turned out that the 5th did close above the Opening High. Normally, I would have entered Long by now. But again, I decided to wait. The 6th bar stayed above the Opening High. My concern was that was a Doji Shape bar, signaling uncertainties and potential reversal. But I decided to enter at the break of the 7th bar. The prices raised along the rising 5eMA. Fearing that it will not hit the 138% Fib. Extension, I exited slightly early because I told myself that I want to end the week with a winning.

Filed Under ~ Gains

Thursday, March 22, 2007

20070322 - AGIX - 15mins - Gain

Symbol: AGIX

Symbol: AGIX

Type: Long

Entry: The beginning of the 6th bar

Exit: The beginning of the 15th bar

Result: Gained of 0.54%

I entered at the beginning of the 6th bar because of the Doji-like 4th bar, and a rather strong 5th bar (closing close to its high). My target was the first-bar high, and the Stop was set at the 4th bar low.

The price did went up as expected in the next 2 bars, but it stayed flat for the remaining of the day. I exited towards the end of the day when the price went up slightly.

Filed Under ~ Gains

Wednesday, March 21, 2007

20070321 - FMT - 15mins - Gain

Symbol: FMT

Type: Long

Entry: The beginning of the 6th bar

Exit: The beginning of the 16th bar

Result: Gained +1.2%

Looking back at this trade, even I think I was too quick to jump in for Long. I was totally anticipating the rising 5eMA is going to support the falling price, when I have absolutely no sign of such support. The price could have just fell right through the 5eMA. I am damn lucky on this trade!

I exited the trade when the price close below the 5eMA on the 15th bar, and took action on the 16th.

A shameful trade even though I ended up with a gain.

Filed Under ~ Gains

Wednesday, March 14, 2007

20070313 - IMH - 15 Min - Gain

Symbol: IMH

Type: Short

Entry: Beginning of 8th bar

Exit: 13th bar at the 119% Fibonacci Level

Result: +1.8%

Gapped down on opening with a strong wide range opening bar. 2nd bar retraced back to almost 50% of the first bar, with long tail touching the opening price line (which signal weakness.) Third bar is a Doji-like formation, and the 4th bar broke the opening price low. The 6th bar tested the Resistance level, and the 7th bar confirmed the Resistance level. I entered at the break of the 8th bar.

Filed Under ~ Gains