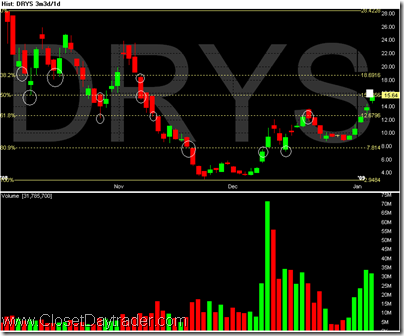

I tried, and wanted, to make a trade today, but I just couldn’t spot any Entries! Here are a few charts that I was looking at this morning.

- It was a NR7 + Inside Bar + (almost) Hammer, and I wanted to go Long had prices broke through the previous bar high

- My Target would be merely the next Fib Level

- It would still put me at 2R profit, had it worked out the way I wanted it to

- It didn’t, and you are looking at the reason why it didn’t

- Fortunately, I didn’t jumped the gun

- With BG, I was hoping that the lowering 5eMA would act as Resistance and push the prices back to the Day-Low

- The Entry Bar was the Inverted Hammer (see circled), and my Entry was set to the Previous Bar low

- I thought with the market in such a Bearish mode, it’s easy to drop back down.

- It didn’t, and my trade didn’t get triggered

- I’m certainly ‘okay’ with it looking at the chart now

- I was hoping for a Base and Break and it never happened

- Once again, I was proud of myself for sticking to my entry rules, and never dive-in ahead of time in anticipation of what *could* happen

- In this case, nothing!

- With TIF, I was almost certain that Yesterday’s Low would act as Resistance and push the prices back towards its Day Low

- Too much wishful thinking there!

- It looks like Yesterday’s Low was blown away just like that!

- As for UBS above, I saw the 3rd Bar Inverted Hammer, but I just couldn’t see an entry in the shorter time-frame

- As prices fell pass the Opening Low, I thought I’ve missed the entry (as mentioned in Twitter.)

- It turned out that this is another ‘Good Miss!’

Overall, I’m proud of myself for sticking to my rules, and not “early-entry” into these positions. But “not trading” means “no money.” I need my trades to be more frequent, and more accurate.