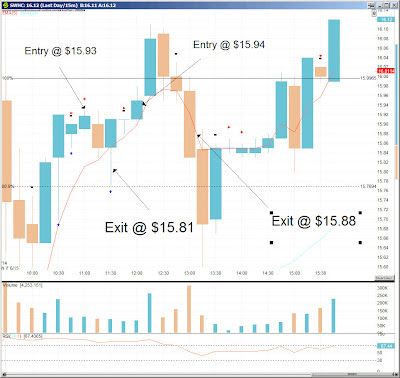

Symbol: SWHC

Type: Long

Entry #1: The top of the 7th bar

Exit #1: During the 9th bar

Result: Lost -0.75%

Entry #2: During the 11th bar

Exit #2: During the 15th bar

Result: Lost -0.38%

Entry #1

- I saw 2 Hammers in a row and I thought it would be the time to enter

- When the prices went above the high of the 5th bar, I entered Long

- When the next bar went back towards the 5eMA... doesn't it sounds familiar?

- The next bar fell below the 5eMA and executed my Protective Stop

- It turned out that the 9th bar was just another Hammer

- With some frustrations, I decided to enter Long again during the 11th bar

- It was in close proximity to the rising 5eMA, and the entry price was already above the 7th bar high

- It turned out that the prices did went past the Opening Range High!

- But the problem was, I had to step away from my desk and I couldn't watch the trade to unfold. I set the Protective Stop based on my entry - slightly below the 5eMA at time of entry

- Had I watch the movement unfold in real-time, I would have adjusted the Stop to the Opening Range High as soon as the price went past it

- In fact, since this is Paper Trading only, I could have recorded the exit at Opening High. But I rather not. I want it to be as close to 'reality' as possible

- Therefore, another loss!

No comments:

Post a Comment